CRO: Bouncing Along the Bottom?

CRO's Rocky Road Since the 2021 Peak

The Cronos (CRO) token, native to the Crypto.com ecosystem, continues to navigate a volatile landscape. As of late November 2025, CRO is hovering around $0.107, a far cry from its all-time high of $0.9698 in November 2021. A quick glance at the charts tells a story of prolonged market weakness, but the question remains: is this just a temporary setback, or is CRO’s fundamental value proposition flawed?

Recent technical analysis paints a mixed picture. CRO has been confined within a tight range of $0.1063 and $0.1092, indicating significant indecision in the market. Resistance at $0.109 has proven firm, with repeated failures to break above this level (a sign of consistent selling pressure). Support at $0.106, however, has held steady, suggesting that buyers are willing to defend this level, at least for now.

The daily simple moving averages (SMAs) and exponential moving averages (EMAs) further complicate the outlook. The shorter-term SMAs (3-day and 5-day) suggest a "sell" action, while the 10-day SMA indicates a "buy." The longer-term SMAs and EMAs, however, overwhelmingly point towards a "sell" (the 200-day SMA is at $0.1418). This divergence highlights the lack of clear direction and the ongoing tug-of-war between buyers and sellers.

It's easy to get lost in the daily price action, but what about the bigger picture? Crypto.com has been actively expanding its visibility through high-profile partnerships, including those with actor Matt Damon and major sports teams. (Remember the Matt Damon "Fortune Favors the Brave" ads? Seemed ubiquitous for a while.) But does celebrity endorsement translate to sustainable token value? The data suggests a more nuanced relationship.

Digging Deeper: Utility vs. Hype

CRO's value, ultimately, is tied to the performance of the Cronos Chain and the adoption of the Crypto.com ecosystem. The recent "Smarturn" upgrade, completed in October 2025, aimed to boost EVM compatibility, scalability, and interoperability. These are tangible improvements that could potentially increase CRO's attractiveness to developers and users. It added EIP-7702 smart accounts, integrated Go-Ethereum v1.15.11 (with Cancun/Prague opcodes), introduced eth_getBlockReceipts, and improved transaction speed through PriorityNonceMempool and AnteCache.

Yet, even with these technical advancements, CRO's price performance has remained subdued. Why? One possible explanation is that the market is increasingly discerning between tokens with genuine utility and those that primarily function as loyalty or rewards mechanisms.

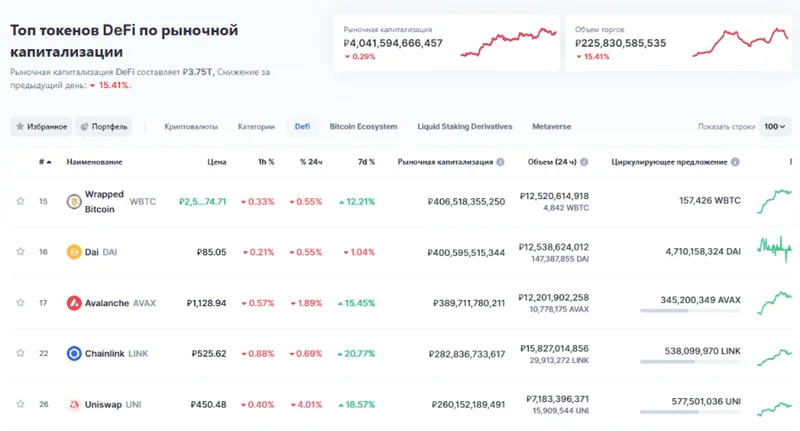

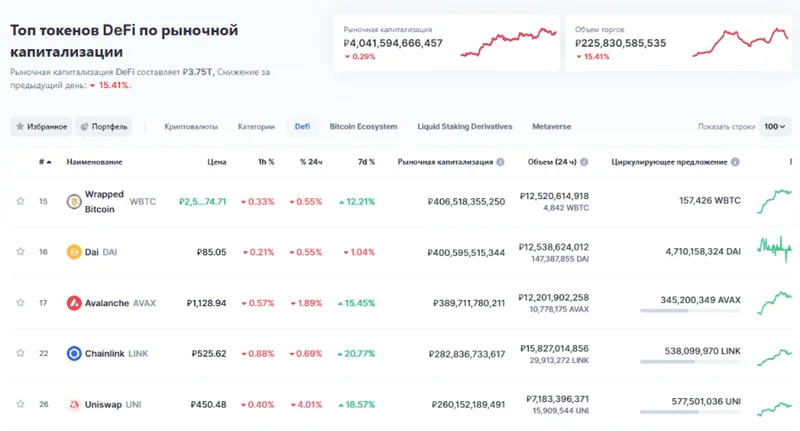

The Striking Dichotomy in DeFi Tokens Post 10 provides further insight into this trend.

Consider these projections for CRO's future price:

* 2025: Minimum $0.1265, Average $0.1294, Maximum $0.1327

* 2026: Minimum $0.3329, Average $0.3443, Maximum $0.3851

* 2027: Minimum $0.4734, Average $0.4906, Maximum $0.5815

* 2028: Minimum $0.7165, Average $0.7410, Maximum $0.8337

* 2029: Minimum $1.05, Average $1.09, Maximum $1.28

* 2030: Minimum $1.51, Average $1.55, Maximum $1.82

* 2031: Minimum $2.11, Average $2.19, Maximum $2.56

These are just forecasts, of course, and should be taken with a grain of salt. (Remember, past performance is not indicative of future results, as the saying goes.) But even if we assume these projections are directionally accurate, the implied growth rate suggests that CRO will need more than just a general crypto market recovery to reach those levels.

The projections hinge on "expansion in DeFi, NFT integrations, and partnerships." But this is where I get skeptical. I've looked at hundreds of these white papers, and the "partnerships" are often just marketing deals, not deep integrations that drive real usage.

The key question is whether CRO can evolve beyond being simply a Crypto.com loyalty token—used to earn higher staking rewards or lower trading fees—and become a fundamental building block for decentralized applications.

What about the community sentiment? The article notes Reddit's XRP community shifted from speculation to utility-focused discussions around RippleNet partnerships. Could a similar shift occur for CRO, or is the community primarily driven by price speculation? Quantifying sentiment is tricky, but tracking the frequency of keywords related to "utility," "DeFi," and "development" versus keywords like "price," "ATH," and "moon" could provide some insight.

Can Crypto.com Deliver?

Crypto.com’s ongoing innovations, such as DEX expansions, NFT integration, and metaverse applications, collectively enhancing CRO’s appeal and utility. These strategic initiatives, along with CRO’s liquidity, staking rewards, and network governance, position it as a solid investment for those with a long-term perspective, especially considering institutional adoption.

But here’s the rub: Crypto.com needs to execute flawlessly on these initiatives. The bear market of 2022-2023 exposed the weaknesses of many centralized crypto platforms, and investors are now demanding greater transparency and accountability.

Will Cronos reach $0.50 by 2027? Or even $1 by 2029? Maybe. But it depends less on market hype and more on Crypto.com’s ability to build a truly compelling and useful ecosystem around the CRO token.

So, Is It a Real Investment or Not?

The data, as it stands, is inconclusive. CRO is not a slam-dunk investment, and it carries significant risk. But if Crypto.com can deliver on its promises and transform CRO into a vital component of a thriving decentralized ecosystem, then the current price may represent a buying opportunity.