The Curious Case of Crypto's 2025 "Maturity"

The narrative surrounding crypto in 2025 is undeniably optimistic, almost suspiciously so. TRM Labs' Global Crypto Policy Review Outlook 2025/26 Report paints a picture of regulatory clarity fueling institutional adoption, stablecoins taking center stage, and a global push for consistent regulation. But as any seasoned analyst knows, it's crucial to dig beneath the surface of these pronouncements and ask: what are the actual numbers telling us? Are we truly witnessing a maturation of the crypto landscape, or just a well-spun narrative built on shaky foundations?

Stablecoin Regulation: Progress or Just Paperwork?

One of the core arguments presented is the rise of stablecoins. The report highlights that over 70% of the jurisdictions reviewed progressed stablecoin regulation in 2025, framing this as a major step forward. It is a positive development. However, the degree to which this translates into real-world utility and stability remains to be seen. Regulatory frameworks on paper don't automatically equate to market confidence or reduced risk. We've seen plenty of regulated financial institutions fail spectacularly. What specific mechanisms are being implemented to ensure the stability of these stablecoins, and how effective are they in practice? What are the actual reserve compositions? The devil, as always, is in the details.

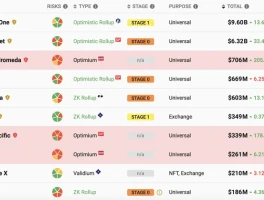

Institutional Influx: Fact or Fiction?

The report also emphasizes the surge in institutional adoption, claiming that financial institutions in about 80% of the reviewed jurisdictions announced new digital asset initiatives. That's a compelling statistic, but announcements don't equal action. How many of these initiatives have actually launched? What's the scale of investment? Are institutions genuinely committing substantial capital, or are they merely dipping their toes in the water for PR purposes? We need concrete data on asset allocation and trading volumes to determine the true extent of institutional involvement.

The Nuances of Regulation: Clarity vs. Restriction

Furthermore, the report acknowledges that jurisdictions with "unclear rules or restrictions on bank participation in digital assets" saw financial institutions take a more cautious stance. This highlights a critical point: regulatory clarity alone isn't sufficient. The nature of the regulation matters just as much. Overly restrictive or punitive regulations could stifle innovation and push institutions away, negating any positive impact.

Regulatory Risk Perception: A Puzzling Paradox

And this is the part of the report that I find genuinely puzzling. The report mentions the Basel Committee's review of its proposed prudential rules for banks' crypto exposures, noting that the original framework would have required full capital deductions for most crypto assets. While the Committee agreed to reassess these rules, the fact that such stringent measures were initially considered raises serious questions about the perceived risk associated with crypto assets within the traditional financial system. If regulators genuinely believed that crypto was maturing into a safe and reliable asset class, why would they propose such draconian capital requirements in the first place? Was it just political posturing?

The Persistent Threat of Illicit Activity

The North Korea's Bybit hack, with losses exceeding $1.5 billion in Ethereum tokens, is a stark reminder of the vulnerabilities that still plague the crypto ecosystem. The report correctly points out that the attackers laundered proceeds through unregulated channels, highlighting the need for better cross-jurisdictional coordination. But this incident also underscores the limitations of existing regulatory frameworks. Even in jurisdictions with relatively robust regulations, illicit actors can exploit loopholes and unregulated technologies to evade detection. The report touts the launch of Beacon Network, an information-sharing platform, but how effective is this platform in practice? What percentage of illicit activity is actually being detected and disrupted?

A Methodological Critique: Whose "Exposure" Are We Measuring?

A critical question arises when examining the report's scope. TRM Labs reviewed crypto policy developments in 30 jurisdictions, representing over 70% of global crypto exposure. But what does "exposure" actually mean in this context? Is it based on trading volume, market capitalization, or some other metric? And who is being "exposed"? Retail investors, institutions, or both? The definition of "exposure" significantly impacts the interpretation of the findings. If the 70% figure primarily reflects institutional exposure, it may not accurately represent the risks faced by retail investors, who are often more vulnerable to scams and market manipulation. It is important to note that the report does not provide enough information to fully assess the validity of these findings.

The Numbers Don't Lie: Cautious Optimism Is Still Just Optimism

The TRM Labs report presents an optimistic outlook for the crypto landscape in 2025, highlighting regulatory progress, institutional adoption, and the rise of stablecoins. While these developments are undoubtedly positive, it's crucial to approach the narrative with a healthy dose of skepticism. A closer examination of the data reveals that the true extent of maturation remains uncertain. We need more transparency, more concrete data, and a more nuanced understanding of the risks involved before we can confidently declare that crypto has truly "grown up."