Okay, everyone, buckle up, because what's happening in the DeFi space *right now* is so much bigger than just a market correction. I know, I know, headlines are screaming about crashes and losses, and yeah, the October 10th event stung. But honestly? I think we're on the verge of something truly revolutionary. We're not just talking about bouncing back; we're talking about a fundamental shift in how we understand and interact with finance itself.

See, everyone's laser-focused on the short-term pain, the tokens down 37% quarter-to-date, the investors running to "safer" havens. But that's like watching a caterpillar and only seeing it crawling on the ground, totally missing the fact that it's about to sprout wings and *fly*. What I'm seeing is a massive recalibration, a Darwinian shakeout where the weak projects are falling away, and the strong, *truly innovative* ones are emerging, ready to lead the charge.

DeFi's "Dichotomy": Resilience Rises from the Ashes

The Real Story Isn't the Dip, It's the Rebound

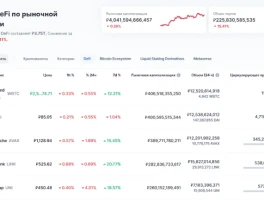

Think about it: FalconX's report highlights that even in this "down" market, some DeFi tokens are not only surviving but *outperforming*. HYPE and CAKE, for example, are showing resilience thanks to buyback programs. MORPHO and SYRUP are thriving on their own unique strengths. This isn't just luck; it's a signal that investors are getting smarter, more discerning, and are starting to reward projects with real utility and solid fundamentals. It's like the early days of the internet boom—remember Pets.com? It crashed and burned, but Amazon? Amazon figured out how to sell books online, and now look at it!

And that's the crucial point: the underlying technology, the promise of decentralized finance, that hasn't gone anywhere. If anything, it's getting stronger, more refined. We're seeing decentralized exchanges becoming more efficient, lending platforms finding new ways to offer value, and the entire ecosystem becoming more resilient to shocks. The "striking dichotomy," as Martin Gaspar at FalconX calls it, is that while some sectors are cheapening, others are becoming *more* expensive. You can read more about this in

The Striking Dichotomy in DeFi Tokens Post 10.

What does this tell us? It tells us that the market is maturing. It's learning what works and what doesn't, and it's starting to price things accordingly. This isn't just about numbers on a screen; it's about real people building real solutions to real-world problems.

Market Dip? More Like a Launchpad!

Opportunity in Market Uncertainty

And here's where it gets *really* exciting. Coinspeaker's research points to Bitcoin's historical pullbacks signaling strong buying windows for *both* BTC and altcoins. Julia Sakovich's view is that Bitcoin's current decline is an *opportunity* for long-term holders, reflecting broader market uncertainty, and this is a healthy correction within an ongoing bull cycle rather than a trend reversal. What does this mean for *us*?

I saw a comment on a Reddit thread the other day that perfectly encapsulates this: "Yeah, the market's down, but I'm using this as a chance to load up on the projects I actually believe in. This is the future, and I'm not missing out." This isn't just blind faith; it's a calculated bet on the power of decentralized finance to transform the world.

DeFi: The Printing Press of the Financial Renaissance?

DeFi's Potential: Democratizing Finance

Remember what happened with the printing press? Initially, it was just a faster way to copy books, but it ended up democratizing knowledge and fueling the Renaissance. I think DeFi has the potential to do something similar—to democratize finance and empower individuals in ways we can barely imagine.

Beyond the Hype: Building a Responsible DeFi Future

A Call for Responsibility

But let's be clear: this isn't a get-rich-quick scheme. It's a long-term investment in a new paradigm. And with that comes responsibility. We need to be mindful of the risks, the potential for scams, and the ethical implications of this technology. We need to build a DeFi ecosystem that is fair, transparent, and accessible to everyone.

This is the kind of breakthrough that reminds me why I got into this field in the first place.

DeFi Rising: A Phoenix From the Ashes of Finance

DeFi: The Dawn of a New Financial Era

DeFi: The Dawn of a New Financial Era

What are the implications of a DeFi Phoenix?

Democratized Finance: The DeFi recovery presents an opportunity for a more inclusive financial landscape, where individuals have greater control over their assets and access to financial services, regardless of their geographic location or socioeconomic status.

Innovation and Disruption: The resurgence of DeFi will likely spur further innovation in blockchain technology and decentralized applications, leading to the development of new financial products and services that challenge traditional systems.

Economic Empowerment: By providing access to decentralized lending, trading, and investment opportunities, DeFi can empower individuals to participate more fully in the global economy and build wealth in a transparent and equitable manner.

DeFi 2.0: Building a Financial System for Everyone

DeFi's Evolution

DeFi's Not Just Bouncing Back, It's Evolving