Bitcoin's "Leveraged Upside" Trade is Dead. Now What?

The crypto markets have been on a rollercoaster lately, and while everyone's focused on the daily price swings, I'm looking at the bigger picture: what happens to the companies that bet big on Bitcoin as a treasury asset? We're talking about firms like MicroStrategy (MSTR), Metaplanet (3350.T), and Semler Scientific (SMLR)—companies whose stock prices became almost a direct, leveraged play on Bitcoin's price. Galaxy Research called it a “liquidity derivative,” and their analysis from July 2025 is proving prescient. The party's over.

The Rise and Fall of the "Equity Beta > BTC Beta" Regime

The core idea was simple: if a company holds a lot of Bitcoin, and Bitcoin goes up, the company's stock should go up even more. This "equity beta > BTC beta" regime worked like a charm for a while, fueled by low interest rates and a seemingly endless appetite for risk. Companies issued stock at a premium, bought more Bitcoin, and the cycle repeated. But as Galaxy Research pointed out, this model only works as long as the equity trades at a premium to its Bitcoin net asset value (NAV). Once that premium collapses, the whole thing reverses, a bit like a perpetual motion machine running out of steam.

The Deleveraging Cascade and its Impact

The October 10, 2025, "deleveraging event" (as Galaxy Research termed it) was the turning point. Forced liquidations in the futures market triggered a liquidity crunch, and the risk-on sentiment evaporated. Suddenly, those Bitcoin treasury companies weren't looking so hot. The same financial engineering that amplified the upside started magnifying the downside. It’s like using a magnifying glass; it'll focus the sun to start a fire, but it can also focus the darkness to make things colder.

Consider Metaplanet, for example. They were sitting on over $600 million in unrealized profits in early October. By December 1, those profits had turned into a $530 million loss. That's a swing of over a billion dollars in less than two months. The drawdowns across the board are striking. Nakamoto (NAKA), for instance, saw its stock price plummet by over 98% from its highs. That's memecoin territory.

And here's the kicker: these companies underperformed Bitcoin itself. Bitcoin is down roughly 30% from its highs, which is a significant move, but the treasury companies are down even more. That's the triple leverage—operational, financial, and issuance—at work. It delivers outsized gains on the way up, but it also delivers an outsized beating on the way down.

The question now isn't if these companies are hurting, but how much and what they're going to do about it. Are they going to start selling their Bitcoin holdings? Will they be able to survive the downturn? Or will they be forced into restructurings or acquisitions?

The Future for Bitcoin Treasury Companies

Galaxy Research sees three plausible outcomes: premiums stay compressed, selective survival and consolidation, and optionality on the next cycle. I think they're right on the money (though, as a former hedge fund analyst, I'm contractually obligated to add my own two cents).

Scenario 1: Compressed Premiums

The "premiums stay compressed" scenario is the most likely in the short term. As long as crypto markets remain soft, these companies will trade at flat or negative premiums to NAV. That means their ability to issue shares and buy more Bitcoin is severely limited. They become, in effect, levered downside plays on Bitcoin, not upside ones. DAT’s All, Folks? What’s Next for Bitcoin Treasury Companies

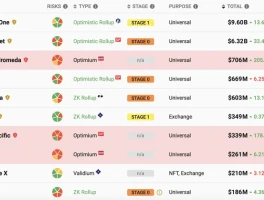

Scenario 2: Selective Survival and Consolidation

The "selective survival and consolidation" scenario is where things get interesting. This downturn is a balance-sheet stress test. The companies that issued the most stock at the highest premiums and bought the most Bitcoin at cycle-top prices are the ones in the most trouble. We could see restructurings, bankruptcies, or acquisitions. MicroStrategy, with its recent announcement of a $1.44 billion cash reserve, seems to be positioning itself to weather the storm. They're signaling that they're prepared for a prolonged period of compressed premiums and weaker Bitcoin prices.

Scenario 3: Optionality on the Next Cycle

And that brings us to the "optionality on the next cycle" scenario. The treasury company trade isn't dead forever. If and when Bitcoin eventually hits new all-time highs, some of these companies will likely regain their equity premiums and reopen the issuance flywheel. But the bar is higher now. Investors will be judging these companies on how they handled this downturn. Did they over-issue? Did they preserve optionality? How did they manage liquidity?

As Galaxy Research put it, these companies now look less like "leveraged upside on BTC" plays and more like "path-dependent instruments whose payoffs depend heavily on issuance strategy and entry timing." In other words, it's not enough to just buy Bitcoin and hope for the best. These companies need to be smart, strategic, and disciplined.

The Tide Has Gone Out

The first phase of the Bitcoin treasury trade is over. Now, we find out who was swimming naked.